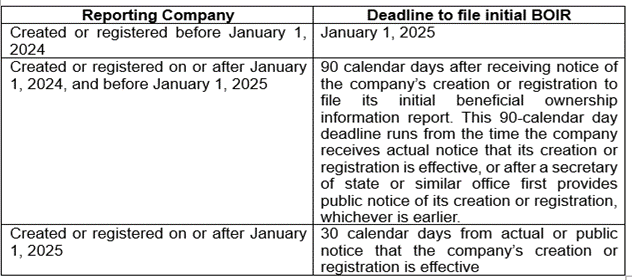

The Corporate Transparency Act (“CTA”), which was enacted in 2021, has a mandatory reporting requirement that took effect on January 1, 2024. The CTA marks a significant shift in regulatory business obligations. If you have a limited liability company (LLC), corporation (C or S corporation), or a limited partnership (LP) you will likely be affected by the reporting requirements of the CTA. If you have any of these entities as part of your estate plan or merely to hold real estate, you may also be required to report under the CTA. As a law firm committed to providing clarity amid legal complexities, we aim to shed light on the requirements of the CTA for our clients. Understanding the Corporate Transparency ActThe CTA is a legislative measure aimed at combating financial crimes by promoting transparency within corporate structures. As a result, the Act mandates entities that are considered “Reporting Companies” to file Beneficial Ownership Information Reports (“BOIRs”), providing detailed information regarding their ownership and control, to the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury. A “Reporting Company” is any entity that is created by filing paperwork with the Secretary of State or any foreign entity required to register in the United States. There are approximately 23 exceptions to what is considered a reporting company. The exceptions include large companies (those with 20 or more employees and $5,000,000 or more in revenues), banks, insurance companies, charities and other entities that are already subject to significant government regulation. The CTA also requires that reporting companies file reports for “Beneficial Owners.” A “Beneficial Owner” is any individual who (1) owns or controls 25% or more of a company’s ownership interests or (2) exercises “substantial control” over a reporting company. Individuals that are part of your company that you may not have considered “owners” prior to this Act, may now be considered Beneficial Owners for purposes of reporting requirements. As a result, you may be required to provide information to FinCEN about these individuals. Relevance to Small BusinessesThe scope of the CTA's reporting requirements encompasses a wide range of entities, including small businesses. Under the CTA, compliance is not merely an option but a legal obligation. Failure to adhere to the reporting requirements or submitting inaccurate or incomplete information could result in severe penalties, including substantial fines and potential criminal liability. Navigating Compliance ObligationsThe core requirement of the CTA revolves around companies reporting beneficial ownership information to FinCEN. This includes disclosing substantial ownership interests and identifying beneficial owners—individuals who directly or indirectly own or control a significant portion of the entity. Entities covered by the CTA must provide details such as the beneficial owner's full legal name, date of birth, current residential address, and a unique identifying number from an acceptable identification document (e.g., driver’s license, passport, or other government-issued identification). As of December 1, 2023, FinCEN has provided the following deadlines: |

|

Preparing for Compliance as a Small BusinessTo proactively prepare for compliance, you should:

The Corporate Transparency Act brings about pivotal changes for businesses. It is crucial for businesses to understand the scope of this legislation, its implications, and take proactive steps towards compliance to avoid potential penalties and legal repercussions. At the Adler Law Firm, our mission is to assist our clients in comprehending and adhering to legal obligations such as the Corporate Transparency Act. We encourage you to contact us with your inquiries regarding this legislation, as we stand ready to provide guidance and support. |